At a time when innovation is at an all time high, and when entrepreneurs thought they had it tough to convince a venture fund to finance their startup, things are going to get a whole lot tougher. The venture industry is contracting! and this is mostly the final blow to that $100-billion overhang from the 1999-2000 fundraising cycle.

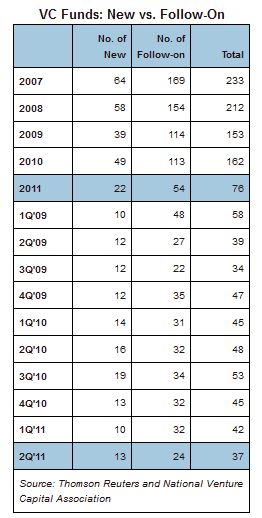

At a time when innovation is at an all time high, and when entrepreneurs thought they had it tough to convince a venture fund to finance their startup, things are going to get a whole lot tougher. The venture industry is contracting! and this is mostly the final blow to that $100-billion overhang from the 1999-2000 fundraising cycle. Thirty-seven US venture capital funds raised $2.7 billion in the second quarter of 2011, according to Thomson Reuters and the National Venture Capital Association (NVCA). This level marks a 28 percent increase by dollar commitments, but a 23 percent decline by number of funds compared to the second quarter of 2010, which saw 48 funds raise $2.1 billion during the period. US venture capital fundraising during the first half of 2011 totaled $10.2 billion from 76 funds, a 67% increase by dollars compared to the first half of 2010 but a 15% decrease by number of funds, marking the lowest number of funds garnering commitments since the first half of 1995.

"The fact that the number of firms raising money successfully remains at such low levels confirms an ongoing contraction of the venture capital industry, which will serve well those funds that can obtain commitments – but that group is becoming more and more narrow," said Mark Heesen, president of the NVCA. "While a smaller venture industry will intuitively produce higher returns, it is critical that the mix of funds remain geographically diverse and cover a broad base of industries if we expect to contribute to economic growth and innovation at the levels we have historically. For that reason, we would like to see more funds raise money in the second half of the year."

"The fact that the number of firms raising money successfully remains at such low levels confirms an ongoing contraction of the venture capital industry, which will serve well those funds that can obtain commitments – but that group is becoming more and more narrow," said Mark Heesen, president of the NVCA. "While a smaller venture industry will intuitively produce higher returns, it is critical that the mix of funds remain geographically diverse and cover a broad base of industries if we expect to contribute to economic growth and innovation at the levels we have historically. For that reason, we would like to see more funds raise money in the second half of the year."There were 24 follow-on funds and 13 new funds raised in the second quarter of 2011, a ratio of 1.8-to-1 of follow-on to new funds. The largest new fund reporting commitments during the second quarter of 2011 was New York-based Level Equity Growth Partners I, L.P., which raised $120 million in its inaugural fund. A "new" fund is defined as the first fund at a newly established firm, although the general partner of that firm may have previous experience investing in venture capital. Adds Rachid Sefrioui, Managing Director of Finaventures: "Clearly investors (LPs) in venture funds have been disenchanted by returns in the last decade, though many have expressed optimism in the second wave of success stories coming out of California".

Courtesy: nvca.org